One of my favourite routines was waking up to read the report card of a US-based trader. It inspired me for the day ahead and filled me with ideas to expand upon.

To this day, writing an end-of-day review is the key tool for my growth. It is the medium to set goals, lay out clear solutions, and track performance through reflection. It highlights any shortcomings and mistakes. The focus areas will change over time, but applying myself through this practice routine is a constant.

I have written extensively about the advantages of a report card in a previous post here.

One of the main services I wanted to offer to readers is a regular overview of this process. What follows is an excerpt from trading on Wednesday 21st August. Going forth, I will publish these posts in a more timely manner at the end of the day so that they are more effective for the reader. Unfortunately, my schedule was disrupted with a shortened week but a regular cadence will be implemented going forth.

The whole idea behind sharing work is to receive feedback. I do not have all the answers and I write to figure it out. Thus, please feel free to comment and collaborate.

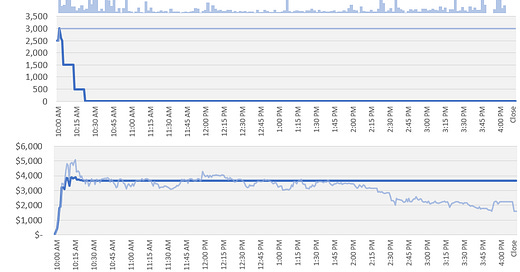

P/L: +$20k

Current Goal:

Increase trade selection and eliminate mistakes.

1 win for the day:

Stuck to my exit rules in JDO to maximise the trade despite the early weakness.

1 change I need to make or area of tension:

I was across the rare earth catalyst pre-open but I didn’t close the loop and I made no plan in LYC. It did eventually breakout and trend very strongly without me. This was a poor interpretation of the catalyst on review. This was the first time in 5 years that quota increases for the 2H have not exceeded 5%. Currently, market prices are very low with little new supply growth. This is a great backdrop for a recovery. I had all this information pre-open but I didn’t prioritise versus other catalysts. Hard with so much on. The solution is to set price alerts at key levels pre-open. Close the loop on grading so that there is no hindsight.

LRV continues to rally strongly on Day 4 but I am out of my position. I maximised the first 2 days but I made no follow-up plan. I do not have a playbook here. The solution is to add another layer to my exit review and examine a trailing stop position on a smaller size.

Keep reading with a 7-day free trial

Subscribe to Baytrading: Insights from an equities day-trader to keep reading this post and get 7 days of free access to the full post archives.